Universal Account Number UAN Number Importance, Benefits, Find UAN & Activation Process: Saving a small portion of your monthly salary in a provident fund account can have a significant impact on your financial future. Both employees and employers are required to contribute equally to the Employees Provident Fund (EPF).

As an employee, you contribute 12% of your basic salary to your EPF account, while your employer matches this amount. However, the employer’s contribution is divided into two parts: 3.67% goes towards your provident fund account, and the remaining 8.33% is allocated to your pension scheme.

Accessing your EPF account is easy. You can do it through your employer or independently using your Unique Account Number (UAN).

What is UAN Number ?

The UAN, or Unique Account Number, is a 12-digit code that grants you access to your Employee Provident Fund (EPF) account. It allows you to perform various transactions related to your EPF account, such as checking your balance, applying for a loan, or making withdrawals. The UAN is assigned by the Employee Provident Fund Organization (EPFO) through your employer when you subscribe to the EPF.

Regardless of job changes, your UAN remains the same, giving you independent access to your provident fund account. Whenever you change jobs, the EPFO generates a new EPF account ID and links it to your existing UAN. This eliminates the need for creating new PF accounts and allows you to conveniently view and reconcile your EPF account history.

How to Find Your UAN Number?

To find your UAN number, you have two options:

- Through your employer: Check your salary slips provided by your employer to find the UAN linked to your PF account. You can also reach out to your company’s HR department for assistance.

- Through the UAN portal: If you can’t find your UAN through your employer, don’t worry! You can retrieve it using the UAN portal. Follow these steps:

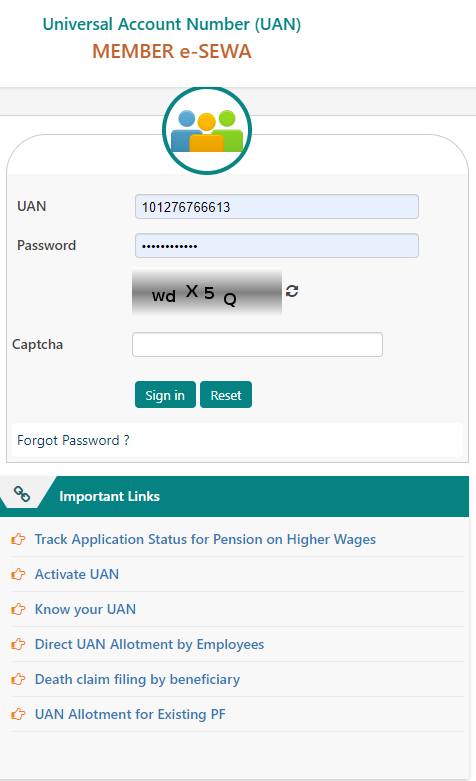

Step 1: Visit the UAN member portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

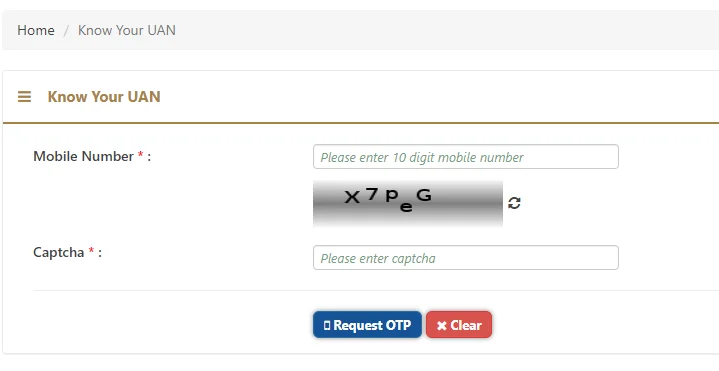

Step 2: Click on the “Know Your UAN” tab and enter your registered mobile number and the captcha.

Step 3: Click on the “Request OTP” button and enter the code.

Step 4: After entering the OTP on the portal, you’ll be redirected to a page where you need to provide your date of birth and details of your PAN card, Aadhaar card, or member ID. Once you’ve entered the required information, click on the “Show My UAN” button.

Step 5: Upon clicking the “Show My UAN” button, another OTP will be sent to your registered mobile number. Enter the OTP into the online form and click on the “Validate OTP and Get UAN” button.

Step 6: Your UAN linked to your PF account will be sent to your registered mobile number.

Features and Benefits of UAN The UAN has simplified the process of verifying employee details for employers. It also enables the EPFO to track an employee’s job changes effectively. The UAN allows the EPFO to extract bank account and KYC details without employer intervention, giving employees independent access to their PF accounts and facilitating online money withdrawals. With the UAN, employers are unable to withhold or avoid paying PF funds to employees.

The unique number has centralized employee data nationwide, making record-keeping easier for the EPFO.

How to Generate a UAN Number?

Typically, the employer generates the UAN on behalf of the employee. Here’s how it works:

Step 1: Visit the EPF employer portal and log in using your establishment’s login ID and password.

Step 2: Go to the Member section and click on the “Register Individual” tab.

Step 3: Enter the required employee information, including date of birth, PAN card number, Aadhaar card number, bank details, and other necessary data.

Step 4: Proceed to the “Approval” section and review and approve all the details.

Step 5: Once approved, the EPFO generates a new UAN. The employer then links the UAN to the employee’s PF account.

Documents Required to Generate UAN To activate and generate a UAN, you will need the following documents:

- ID proof (e.g., driving license, passport, voter ID)

- Address proof (e.g., utility bill older than 3 months, driving license, rent/lease agreement)

- PAN card

- Aadhaar card

- ESIC card

- Bank details (account number, IFSC code, and branch name)

How to Activate Your UAN?

After generating your UAN, it’s essential to activate it. Follow these steps:

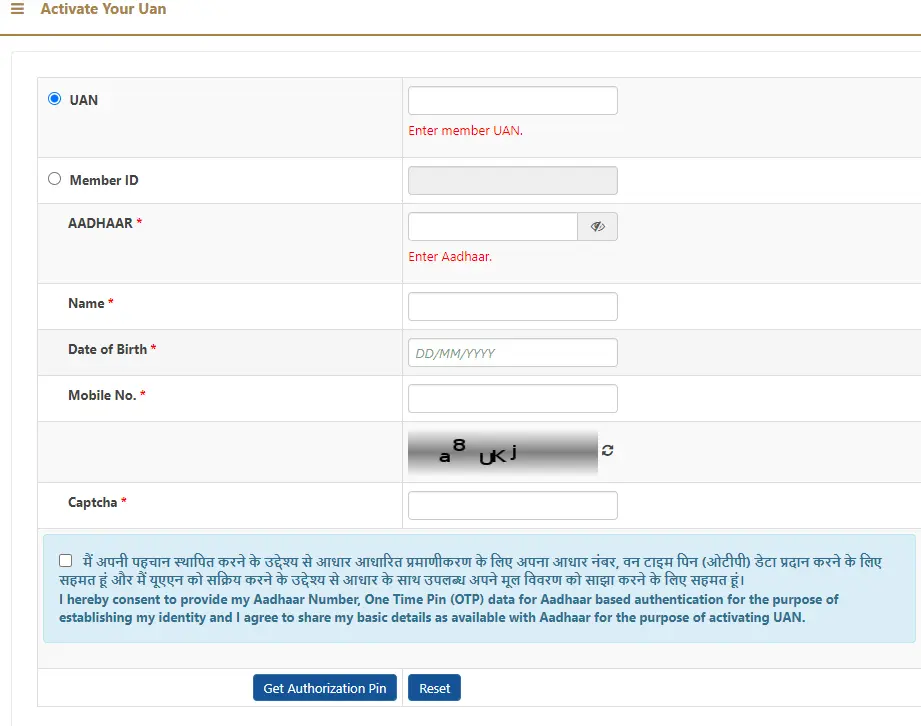

Step 1: Visit the EPFO website and click on the “Activate UAN” button under the “Important Links” tab.

Step 2: Enter your UAN, member ID, Aadhaar card number, or PAN card number. Provide your personal information, such as your name, mobile number, date of birth, and email ID.

Step 3: After entering all the required details, click on the “Get Authorization PIN” button. You’ll receive an OTP on your registered mobile number.

Step 4: Enter the received PIN and click on the “Validate OTP and Activate UAN” button to activate your UAN successfully.

How to Link UAN with Aadhaar Card?

You can link your Aadhaar card to your UAN account through various methods, including online and offline options. To link your Aadhaar card to UAN using the EPFO website, follow these steps:

Step 1: Visit the EPF online member portal and log in using your UAN number and password.

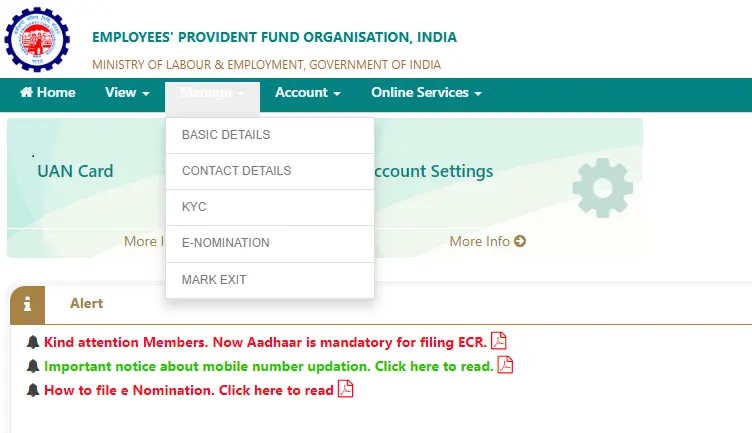

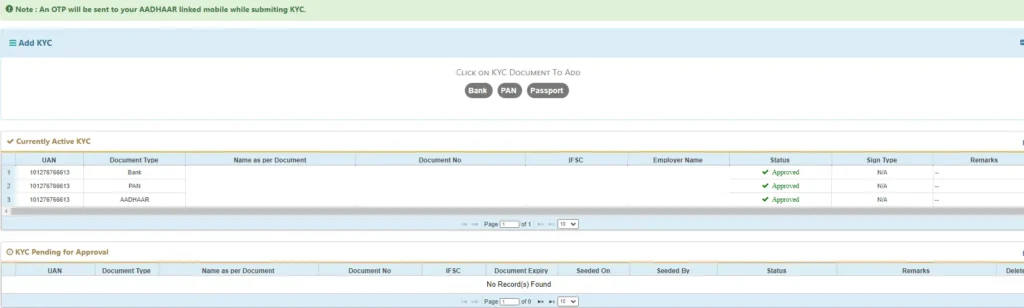

Step 2: Go to the “Manage” section and click on the KYC option.

Step 3: Select the “Aadhaar” option and enter your Aadhaar number along with your name.

Step 4: Click on the “Save” button to submit the details. Your Aadhaar information will be verified by the UIDAI.

Step 5: Once verified, your UAN and Aadhaar will be linked, and you’ll see “Verified” next to your Aadhaar card details.

How to Link Multiple EPF Accounts with One UAN?

Here’s how you can link multiple EPF accounts to one UAN:

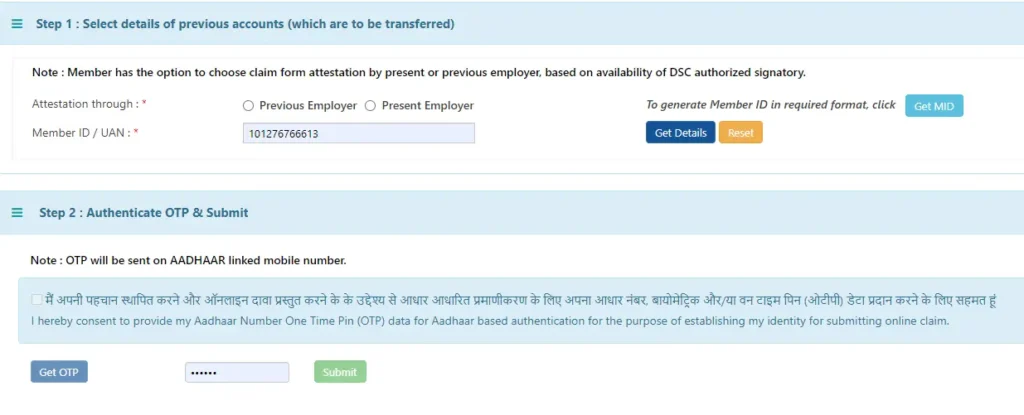

Step 1: Visit the EPFO web portal and click on the “Our Services” tab.

Step 2: Click on the “For Employee” button, followed by the “One Employee – One EPF Account” button.

Step 3: Fill in the required details, including your current member ID, mobile number, and UAN.

Step 4: Click on the “Generate OTP” button, which will send a one-time code to your registered mobile number. Enter the code on the webpage.

Step 5: Enter your old EPF ID, accept the declarations, and submit your request.

Please note that you can only link multiple EPF accounts once your UAN is activated. The linking service becomes available three days after UAN activation.

In conclusion, having a provident fund account is crucial for securing your retirement and enjoying benefits such as tax exemption after five years of service. Keeping your UAN updated and knowing how to access it is key to leveraging these advantages. Your UAN is the gateway to your provident fund account and essential for online withdrawals.

We hope you found this information useful for securing your financial future.