Income Mismatch in ITR: Resolving disparities in income between your Income Tax Return (ITR) and Form 26AS (tax credit statement) involves a strategic approach with distinct steps:

To fully leverage the Tax Credit Mismatch service, it is imperative to fulfill the following criteria:

Registered e-Filer: Ensure that you are a registered user on the e-Filing portal, possessing a valid and secure username/password combination. This registration guarantees a protected gateway to your tax-related data.

Active PAN: Maintain a valid and active Permanent Account Number (PAN), serving as your distinctive tax identifier.

Past ITR Filing: Have a track record of filing at least one Income Tax Return (ITR) for the specific Assessment Year (AY) under consideration. This prerequisite enables the system to juxtapose your reported income against official records.

Verified Tax Credits: Verify that TDS (Tax Deducted at Source) or TCS (Tax Collected at Source), along with any Income Tax payments made, are accurately reflected in your Form 26AS on the e-Filing portal. This form acts as a consolidated repository of your tax credits, ensuring precision.

Established ERI Connection (for Entity Registration Individuals): If utilizing the service as an Entity Registration Individual (ERI), confirm that the entity you represent has been added to the e-Filing portal, and they have designated you as a Client. This establishes a formal connection, granting authorized access to their tax-related information.

Active ERI Status (for Entity Registration Individuals): For ERIs, maintain an active status within the e-Filing portal. This status is crucial to ensuring proper access and authorization for undertaking actions on behalf of the represented entity.

Step by Steps for Income Mismatch in ITR

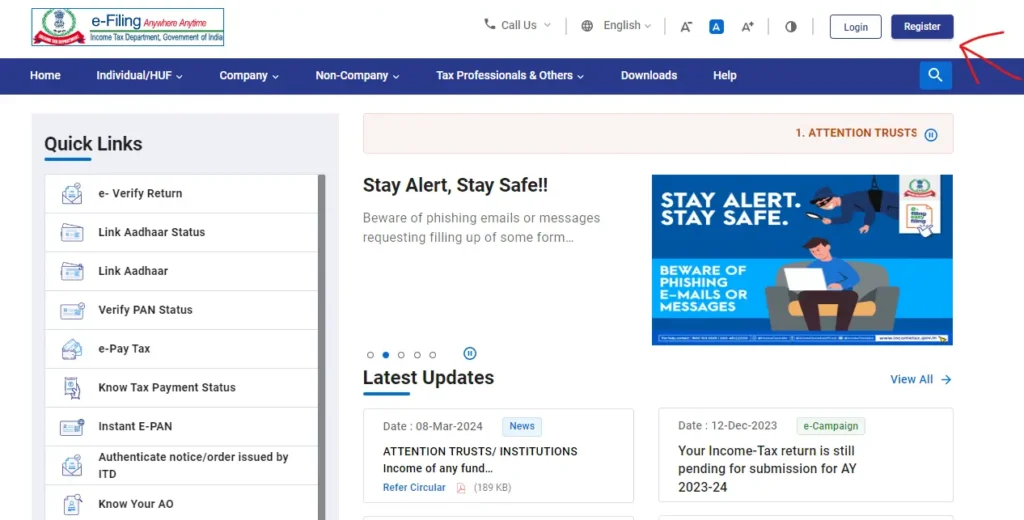

- Access Your Account: Commence by logging into the e-Filing portal using your unique user ID and password.

- Navigate to Tax Credit Mismatch: Once within your personalized Dashboard, navigate to the “Services” tab and select “Tax Credit Mismatch.”

- Specify Assessment Year: On the Tax Credit Mismatch page, opt for the Assessment Year for which you desire to scrutinize mismatch details. Click “Submit,” noting that your PAN will be automatically pre-filled for your convenience.

- Unveil Mismatch Details: Witness the unveiled discrepancies between the TDS, TCS, and Income Tax payment details you provided in your Income Tax Return versus what is mirrored in Form 26AS. Take note:

If the mismatch records surpass 10, conveniently download them in PDF/XLS format by clicking “Download.”

For 10 or fewer mismatch records, you have the option to view them directly on the Tax Credit Mismatch page or download them in PDF/XLS format using the “Download” button.

Embark on this seamless journey to gain comprehensive insights into the alignment of your reported tax data and Form 26AS.

Uncover the Discrepancy Origins of income Mismatch in ITR

The Income Tax department facilitates a comprehensive tool accessible on the e-filing portal (https://www.incometax.gov.in/iec/foportal/help/how-to-manage-tax-credit-mismatch), allowing you to discern disparities in TDS/TCS, advance tax, or self-assessment tax reported in your ITR compared to the information reflected in Form 26AS.

Tailor Solutions to the Root Cause:

In the event of a personal error:

- Rectify through Revised Return (ITR-U): This avenue remains open if you haven’t received a Section 143(1) notice from the Income Tax department.

- Initiate Rectification Request: If a Section 143(1) notice has been issued, rectify minor ITR errors by submitting a rectification request.

In the case of an employer/deductor error:

- Notify them of the discrepancy, prompting a revised TDS return with accurate information.

In instances where the cause of the mismatch eludes explanation:

- Consider filing an Updated Income Tax Return (ITR-U) to rectify potential under-reporting, albeit with possible interest and penalty charges.

Addressing income disparities in your ITR is paramount to preempting tax demands or penalties from the vigilant Income Tax department.