The Pradhan Mantri Svanidhi Yojana (PM Svanidhi Yojana) is a flagship initiative launched by the Government of India in 2020 to empower small traders and street vendors.

This scheme, introduced in the wake of the COVID-19 pandemic, aims to support businesses affected by lockdowns and restrictions by providing financial assistance without the need for collateral.

Let’s dive into the details of the scheme, how it works, eligibility criteria, and the application process.

What is the PM Svanidhi Yojana?

Contents

The PM Svanidhi Yojana was launched to help street vendors and small traders regain their financial footing post-COVID-19. The scheme provides incremental loans in three phases to encourage timely repayment and ensure financial inclusion:

- First Loan: ₹10,000

- Second Loan: ₹20,000 (upon repayment of the first loan)

- Third Loan: ₹50,000 (upon repayment of the second loan)

This progressive loan structure motivates borrowers to repay their loans promptly and become self-reliant.

Key Features of the Scheme

- No Collateral Needed: Loans under the PM Svanidhi Yojana are collateral-free, making it easier for small vendors to access credit.

- Aadhaar Card Requirement: An Aadhaar card is mandatory for loan applications.

- Repayment Period: Loans must be repaid in monthly installments within 12 months.

- Recommendation Letter: A letter of recommendation from urban local bodies (ULBs) may be required for additional benefits under the scheme.

Eligibility for PM Svanidhi Yojana

The scheme categorizes vendors into four groups based on eligibility. Borrowers must check their eligibility on the official PM Svanidhi portal before applying.

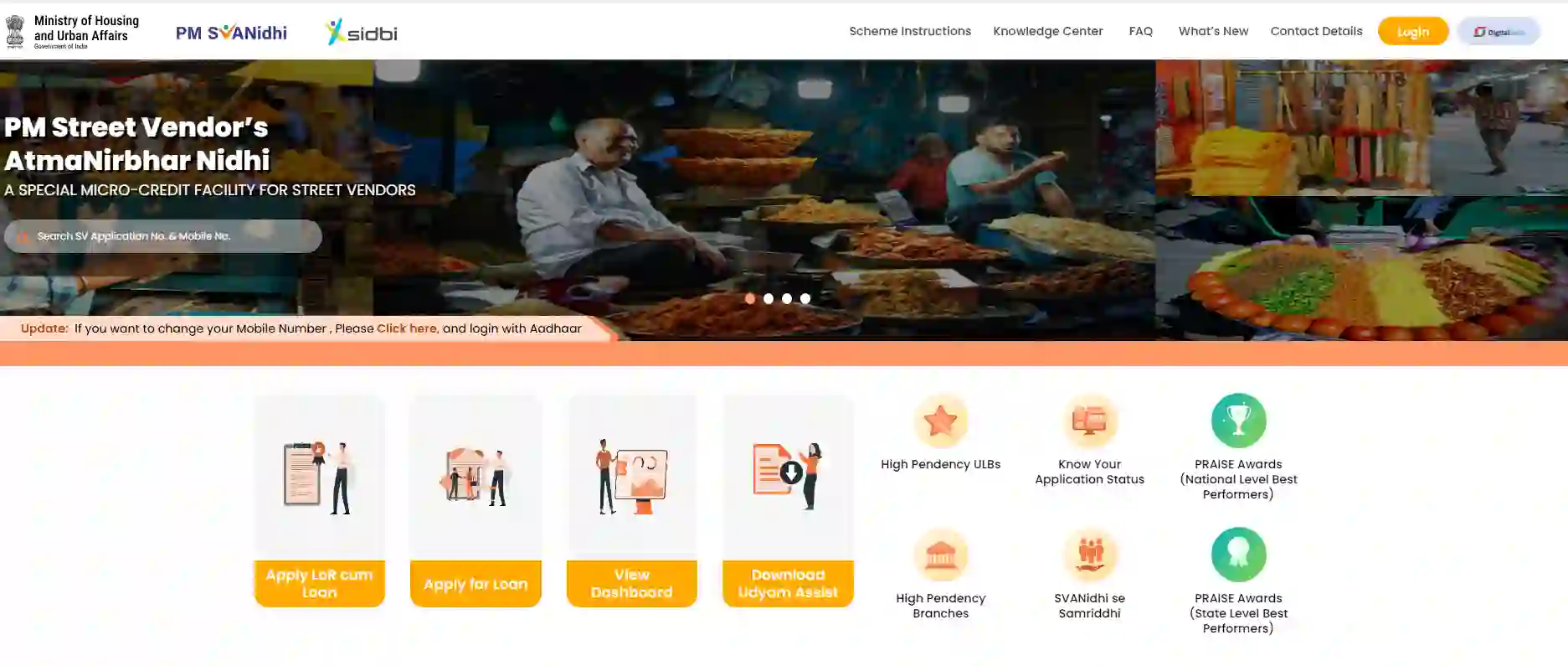

How to Apply for the Loan?

The application process for the PM Svanidhi Yojana is simple and can be done either online or at Common Service Centres (CSCs).

Step 1: Link Mobile Number with Aadhaar

To start the application process, ensure that your mobile number is linked to your Aadhaar card. This is essential for e-KYC and Aadhaar validation.

Step 2: Gather Necessary Documents

While filling out the Loan Application Form (LAF), you must provide necessary details, including your Aadhaar card information.

Step 3: Check Eligibility Status

Visit the PM Svanidhi portal to verify your eligibility. Vendors should ensure they fall under one of the four eligible categories before proceeding.

Step 4: Submit Your Application

- Online: Apply directly on the PM Svanidhi Yojana portal.

- Offline: Visit a nearby Common Service Centre (CSC) or government bank for assistance.

Additional Benefits

Borrowers who repay their loans on time may benefit from lower interest rates in subsequent loans. Furthermore, linking the Aadhaar card ensures access to other government welfare schemes in the future.

FAQs

1. What is the primary objective of the PM Svanidhi Yojana?

The scheme aims to provide financial assistance to street vendors and small traders affected by the COVID-19 pandemic, helping them restart and sustain their businesses..

2. Who is eligible for the PM Svanidhi Yojana?

Eligibility criteria include:

Street vendors engaged in vending before or during the COVID-19 lockdown.

Vendors must belong to one of the four categories defined on the PM Svanidhi portal.

An Aadhaar card linked to a mobile number is mandatory for e-KYC.

3. How much loan amount is provided under the scheme?

The loan is provided in three incremental phases:

First Loan: ₹10,000

Second Loan: ₹20,000 (upon full repayment of the first loan)

Third Loan: ₹50,000 (upon full repayment of the second loan).

4. What is the repayment period for the loan?

Loans under the scheme must be repaid in monthly installments within 12 months. Timely repayment makes borrowers eligible for the next loan with lower interest rates.

5. How can vendors apply for the PM Svanidhi Yojana?

Vendors can apply:

Online: Through the official PM Svanidhi portal by completing Aadhaar-based e-KYC.

Offline: By visiting nearby Common Service Centres (CSCs) or government banks for assistance.

Conclusion

The PM Svanidhi Yojana has been instrumental in helping small traders and street vendors rebuild their businesses and livelihoods. With its easy application process, Aadhaar-based verification, and collateral-free loans, it continues to support the backbone of India’s informal economy.

If you’re a street vendor or small trader, don’t miss out on this opportunity to access financial aid and grow your business. Apply today through the official PM Svanidhi portal or your nearest CSC!